Like many other manufacturers you could be overpaying in tax due to lack of a predominant use study.

What is a Predominant Use Study?

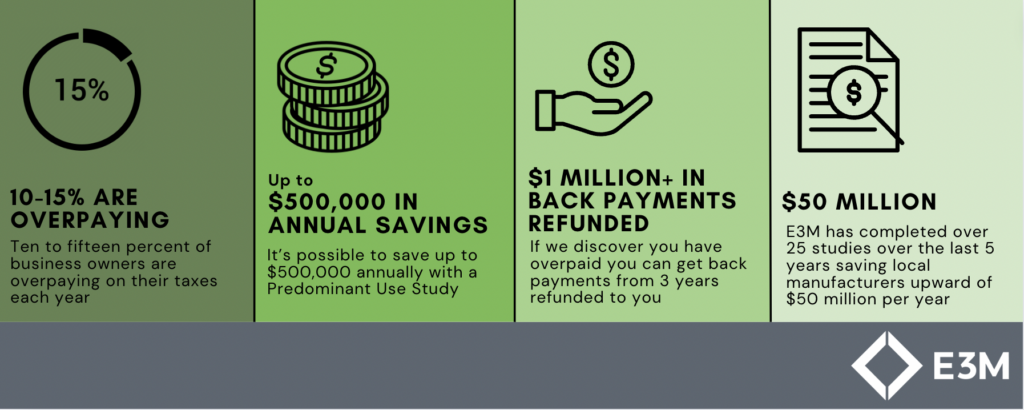

As a manufacturer you are charged sales tax by your state based on energy usage however, energy used in the production of an end good is non-taxable. As a result, we have found that 10-15% of manufacturers are overpaying in taxes every year in either paying full sales tax or overpaying based on how they filed for exemption.

Typically, manufacturers self-evaluate on square footage of production vs non-production space. This is good; however, production is much more energy intensive then warehousing or office causing overpayment. To more accurately report based on actual energy usage, states require you to hire an engineer to complete a predominant use study diving into actual energy usage by space or system. With this approach, over the last 5 years E3M has completed over 25 predominant use studies saving manufacturers a total of almost $5 Million PER YEAR.

Are you Overpaying in Sales Tax?

It’s simple to find out if you’re overpaying in sales tax:

- Look at any gas or electric bill to check.

- Find the sales tax line item on either bill.

- Is that number equal to your local state sales tax rate (6% in Michigan) of your total bill?

- If yes, you’re overpaying and should complete a predominant use study to discover savings.

We Can Help.

- E3M can complete a predominant use study to prove what is taxable and not taxable.

- We can earn your company a refund for the last 3 years (called a rake back).

- New studies will be required any time business ownership changes or on state expiration. As example in Michigan, the study is good for 4 years at which point we’ll repeat the study.

Follow Their Lead

We’ve completed Predominant Use Studies for 25 Manufacturers around the Country over the Past 5 Years.

Complete the Form Below to Get a Refund and Start Saving Today!